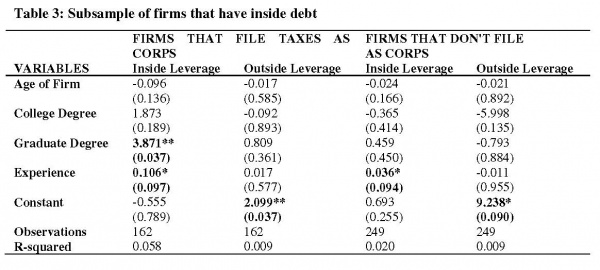

In the United States, income earned by entities operating in corporate form is taxed twice: once at the corporate level when earned and again at the shareholder level when distributed in the form of a dividend. As a result, shareholders have long sought to mitigate the effect of this double taxation. Using data from the U.S. Federal Reserve’s Survey of Small Business Finances for 2003, this study explores the extent to which shareholders of U.S. corporations make use of debt financing to reduce overall tax expense. By looking at firm owners with varying degrees of sophistication operating businesses in both corporate and pass-through form, we demonstrate that more sophisticated owners, particularly those with graduate degrees, make use of this tax planning method more often than others. (2012)

SBA Knowledge Center

Leave a Reply