GASB Statement 68 on Pensions: A Solution to the Public Pension Crisis? – Dr. Eddy Birrer

Numerous articles in the popular press have highlighted financial problems facing state and local governments. According to a 2013 report issued by The PEW Charitable Trusts, there exists an unfunded pension gap in 61 key U.S. cities totaling more than $217 billion (A Widening Gap in Cities: Shortfalls in Funding for Pensions and Retiree Health Care, p. 2). For example, Lexington, Kentucky, had an unfunded pension liability of $296 million dollars in 2012 which the mayor said was caused by “optimistic investment-return assumptions, a punishing market decline, benefit sweeteners made without understanding their long-term impact, and chronic shortfalls in governmental contributions.” Several solutions to the pension problem have been proposed or enacted by various state and local governments, including issuance by the Governmental Accounting Standards Board (GASB) of Statement No. 68, Accounting and Financial Reporting for Pensions. This paper summarizes the key provisions of the Statement, and offers suggestions for future study of governmental pension accounting.

Journal of Government Financial Management, Vol. 63, No. 3, Fall 2014

Publication Contact Author

The Effect of Deregulation and Capital Market Incentives on Voluntary Disclosure in the Electric Utility Industry – D.G. Deboskey & Sara Kern

There are many incentives that impact managers’ disclosure decisions. This paper primarily examines one of these incentives – the capital market incentive. We offer a unique setting, the electric utility industry as it transitioned through deregulation, and we show a positive association between voluntary disclosure and deregulation in the post-regulation era. This paper also examines the consistency of four proxies used by accounting researchers to measure disclosure levels: analyst following, analyst forecast revisions, analyst forecast accuracy, and a self-constructed measure. Overall, our results provide empirical evidence that the deregulation of the electric utility industry is strongly associated with an increase in voluntary disclosure, providing additional evidence to support existing theories explaining firms’ voluntary disclosure of information. We find mixed supporting evidence for the supplemental proxies. Our findings offer support to regulators that seek to justify the impact of deregulation on disclosure and capital market participants including analysts and firms

Publication Contact Author

Trends in the Shifting of Resources by U.S.-Based Multinational Companies – Andrew Brajcich

The U.S. has one of the highest statutory corporate tax rates among economically developed countries. Corporate officers are under pressure to minimize their company’s effective tax rate and tax practitioners have developed sophisticated international structures to facilitate their clients’ needs. Common wisdom among multinational corporations (MNCs) is to utilize low-tax jurisdictions to reduce overall tax expense. Concerns of an exodus of U.S. capital to low-tax foreign jurisdictions have led to much debate in the halls of Congress on the U.S. taxation of MNCs. This study analyzes the extent to which MNCs make use of low-tax jurisdictions and considers many non-tax factors that may influence investment abroad, including business climate and economic activity. We find that tax rates do influence where MNCs shift income, but to a limited extent and only after foreign operations are established.

The U.S. has one of the highest statutory corporate tax rates among economically developed countries. Corporate officers are under pressure to minimize their company’s effective tax rate and tax practitioners have developed sophisticated international structures to facilitate their clients’ needs. Common wisdom among multinational corporations (MNCs) is to utilize low-tax jurisdictions to reduce overall tax expense. Concerns of an exodus of U.S. capital to low-tax foreign jurisdictions have led to much debate in the halls of Congress on the U.S. taxation of MNCs. This study analyzes the extent to which MNCs make use of low-tax jurisdictions and considers many non-tax factors that may influence investment abroad, including business climate and economic activity. We find that tax rates do influence where MNCs shift income, but to a limited extent and only after foreign operations are established.

Publication Contact Author

People, Corporations, Economic Decisions, and Political Speech – Dr. Gerhard Barone and Dr. Kent Hickman

The Supreme Court’s decision in Citizens United v. FEC eliminates restrictions on the ability of corporations to make independent expenditures for speech that is electioneering in nature. Crucial in the opinions of both the majority and the dissent in the case is whether the First Amendment’s freedom of speech protection should be applied equally to corporations as it is to natural persons. On this topic, the majority concludes that “the First Amendment does not allow political speech restrictions based on a speaker’s corporate identity.” (558 U.S. at 31) On the contrary, the dissenting opinion quotes prior Court decisions in concluding that “the special characteristics of the corporate structure require particularly careful regulation.” (558 U.S. at 2) The special characteristics of corporations that the dissenting opinion lists in support of this conclusion include: limited liability; perpetual life; separation of ownership and control; and favorable treatment of the accumulation and distribution of assets (558 U.S. at 75, among others). In this paper, we highlight an additional characteristic, rooted in economic theory, that we believe adds to the distinction between persons and for-profit corporations. Specifically, we argue that individuals strive to maximize utility and for-profit corporations strive to maximize wealth and that this fundamental distinction and its consequences should have been considered by the Court.

Publishers Contact Authors: Dr. Gerhard Barone Dr. Kent Hickman

Monitoring Legal Compliance: The Growth of Compliance Committees – Dr. Sara Kern

Monitoring Legal Compliance: The Growth of Compliance Committees – Dr. Sara Kern

The Committee of Sponsoring Organizations’ (COSO) framework outlines three objectives of internal control. This paper addresses the third and least emphasized component, compliance with laws and regulations. We address the growing importance of board-level oversight of legal compliance and the emerging role of a separate board committee dedicated to the compliance function. A recent COSO project emphasizes the importance of the monitoring function; COSO observes that many companies are not conducting this function effectively. We examine the use of a board-level compliance committee to monitor legal compliance. We also discuss the roles of corporate counsel and internal auditors in assisting with monitoring. Our results show that over the last 15 years a growing percentage of S&P 500 firms have adopted a board-level compliance committee. Internal auditors’ specialized training and expertise in the areas of monitoring and prevention would complement the company’s legal expertise and be of significant value to boards of directors in helping them fulfill their compliance oversight responsibilities.

Publication Contact Author

Commentary from the American Accounting Association’s 2011 Annual Meeting Panel on Emerging Issues in Fraud Research – Dr. Sara Kern (Melendy)

At one of the forensic and investigative accounting panels at the American Accounting Association’s 2011 Annual meeting, panelists discussed some of the common misconceptions about fraud, the dearth of articles related to fraud examination and forensic accounting published in the mainstream accounting journals, and the many opportunities for future research in these areas. They also discussed the publication process as it relates to articles on fraud examination and forensic accounting topics. This article summarizes their discussion, and also draws upon some of the relevant published literature to highlight some of the fraud topics that are still largely unexplored and thus ripe for academic research.

Publication Contact Author

Utilizing Debt as a Tax Benefit: The Capitalization of U.S. Corporations and Owner Sophistication – Andrew Brajcich

Utilizing Debt as a Tax Benefit: The Capitalization of U.S. Corporations and Owner Sophistication – Andrew Brajcich

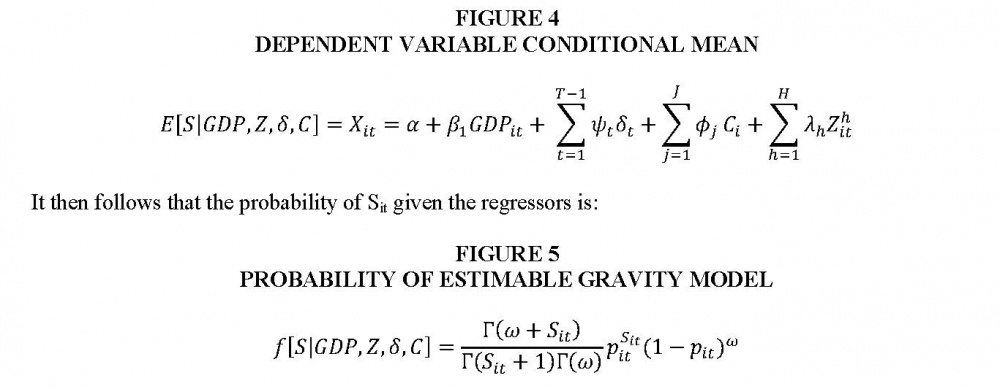

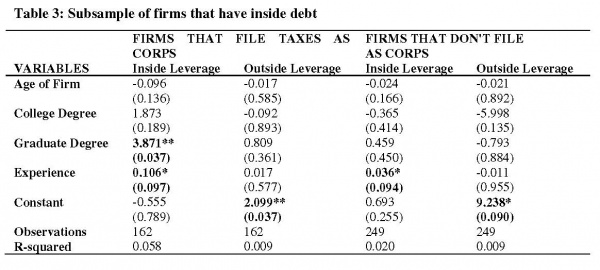

In the United States, income earned by entities operating in corporate form is taxed twice: once at the corporate level when earned and again at the shareholder level when distributed in the form of a dividend. As a result, shareholders have long sought to mitigate the effect of this double taxation. Using data from the U.S. Federal Reserve’s Survey of Small Business Finances for 2003, this study explores the extent to which shareholders of U.S. corporations make use of debt financing to reduce overall tax expense. By looking at firm owners with varying degrees of sophistication operating businesses in both corporate and pass-through form, we demonstrate that more sophisticated owners, particularly those with graduate degrees, make use of this tax planning method more often than others. (2013)

Publication Contact Author

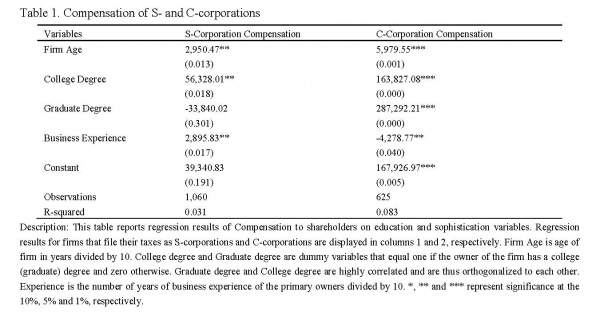

Minimizing Employment Taxes in U.S. “S” Corporations: Levels of Compensation and Shareholder Sophistication–Andrew Brajcich

In the U.S., firm owners operating as an S corporation may minimize the incurrence of employment tax by reducing compensation paid to shareholder-employees and increasing the amount of tax-free distributions from the firm. While the U.S. limits a taxpayer’s ability to use this technique, many firm owners are still able to reduce employment tax expense to some degree. Using the U.S. Federal Reserve’s 2003 Survey of Small Business Finances, we find that more sophisticated S corporation owners make use of this tax planning technique than their counterparts operating in C corporations. (2012)

Leave a Reply