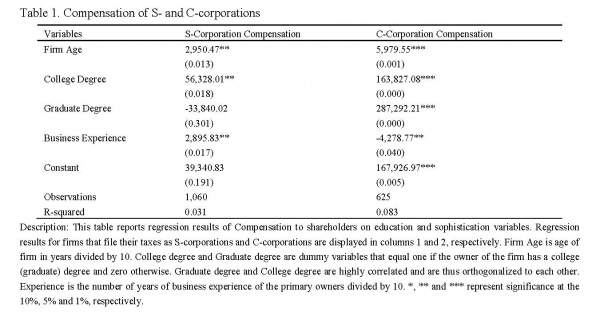

In the U.S., firm owners operating as an S corporation may minimize the incurrence of employment tax by reducing compensation paid to shareholder-employees and increasing the amount of tax-free distributions from the firm. While the U.S. limits a taxpayer’s ability to use this technique, many firm owners are still able to reduce employment tax expense to some degree. Using the U.S. Federal Reserve’s 2003 Survey of Small Business Finances, we find that more sophisticated S corporation owners make use of this tax planning technique than their counterparts operating in C corporations. (2013)

In the U.S., firm owners operating as an S corporation may minimize the incurrence of employment tax by reducing compensation paid to shareholder-employees and increasing the amount of tax-free distributions from the firm. While the U.S. limits a taxpayer’s ability to use this technique, many firm owners are still able to reduce employment tax expense to some degree. Using the U.S. Federal Reserve’s 2003 Survey of Small Business Finances, we find that more sophisticated S corporation owners make use of this tax planning technique than their counterparts operating in C corporations. (2013)

SBA Knowledge Center

Leave a Reply