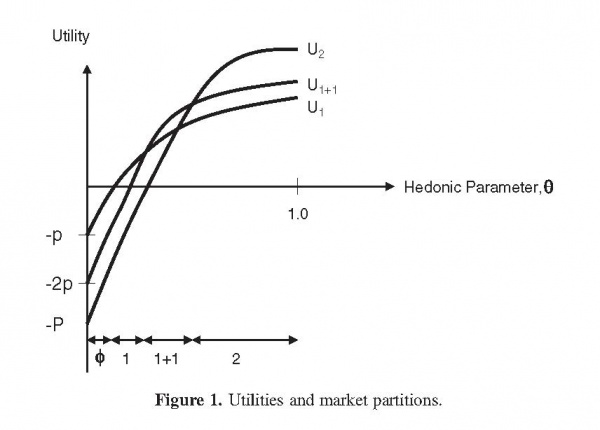

A curious phenomenon in the retail pricing of many product categories (e.g., tuna, frozen orange juice, and tomato paste) is the existence of quantity surcharges. A related curiosity is the existence of both discounts and surcharges within the same product category. To explain the former phenomenon, extant research invokes heterogeneity in consumption parameters, heterogeneity in search costs, or concern for retail price image. To the best of our knowledge, there is no received explanation for the latter phenomenon.We add to this rich stream of work by proposing a novel explanation for quantity surcharges. Our explanation is based on the notion of consumption hassle. We analyze a market that is heterogeneous in a hedonic parameter that influences valuations as well as the effective cost of the consumption hassle. We then derive consumer choices (small pack, large pack, or two small packs) taking into account Individual Rationality (IR) and Incentive Compatibility (IC) constraints. In the absence of consumption hassle, we obtain two segments with one purchasing the small pack and the other purchasing the large pack. Moreover, the optimal pricing for the seller involves quantity discounts. However, with the introduction of consumption hassle, the market potentially splits into three segments: one purchasing the small pack, another purchasing two small packs, and the third purchasing the large pack. Moreover, the optimal pricing for the seller involves quantity surcharges.Overall, our analytical findings offer an additional explanation for the phenomenon of quantity surcharges. More importantly, they offer a rationale for the existence of multiple pricing schedules within the same product category by explicitly recognizing variations in consumption hassle.

Publication Contact Author

Leave a Reply