The U.S. has one of the highest statutory corporate tax rates among economically developed countries. Corporate officers are under pressure to minimize their company’s effective tax rate and tax practitioners have developed sophisticated international structures to facilitate their clients’ needs. Common wisdom among multinational corporations (MNCs) is to utilize low-tax jurisdictions to reduce overall tax expense. Concerns of an exodus of U.S. capital to low-tax foreign jurisdictions have led to much debate in the halls of Congress on the U.S. taxation of MNCs. This study analyzes the extent to which MNCs make use of low-tax jurisdictions and considers many non-tax factors that may influence investment abroad, including business climate and economic activity. We find that tax rates do influence where MNCs shift income, but to a limited extent and only after foreign operations are established.

The U.S. has one of the highest statutory corporate tax rates among economically developed countries. Corporate officers are under pressure to minimize their company’s effective tax rate and tax practitioners have developed sophisticated international structures to facilitate their clients’ needs. Common wisdom among multinational corporations (MNCs) is to utilize low-tax jurisdictions to reduce overall tax expense. Concerns of an exodus of U.S. capital to low-tax foreign jurisdictions have led to much debate in the halls of Congress on the U.S. taxation of MNCs. This study analyzes the extent to which MNCs make use of low-tax jurisdictions and considers many non-tax factors that may influence investment abroad, including business climate and economic activity. We find that tax rates do influence where MNCs shift income, but to a limited extent and only after foreign operations are established.

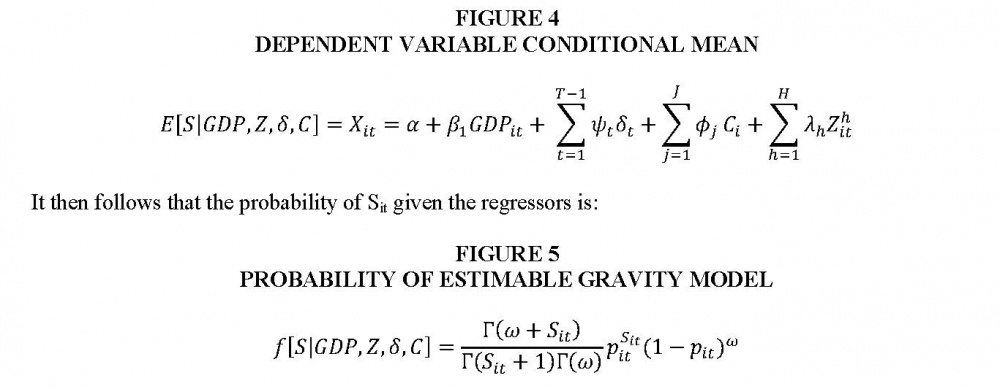

Leave a Reply